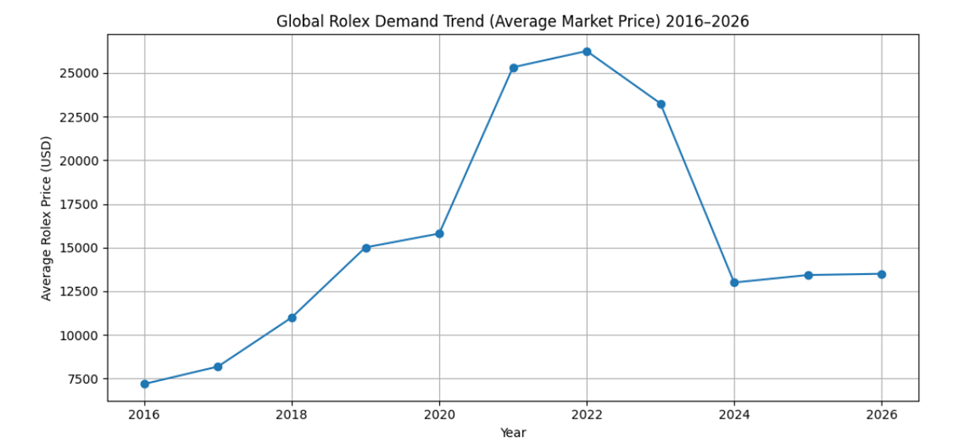

Rolex Prices on the Rise in 2026: Expert Analysis

Rolex remains the most desired luxury watch brand. Demand continues growing across global luxury markets. Collectors view Rolex as financial and emotional assets. This demand strongly affects modern pricing trends. Rolex prices have risen consistently over recent years. The year 2025 continues this upward pricing movement. Several market forces drive these price increases. Each force influences supply, demand, and perception. Understanding these factors helps buyers and investors. It also explains why rolex prices keep climbing.

Global Demand Continues Expanding

Global wealth growth fuels luxury consumption worldwide. High net worth individuals keep increasing globally. Luxury watches benefit directly from rising wealth. Asia shows strong growth in luxury demand. China remains a major Rolex consumption market. India also contributes growing luxury interest.

Middle Eastern buyers favor luxury Swiss watches. Europe remains historically strong for Rolex demand. The United States drives premium watch sales growth. Rolex prices respond directly to global demand pressure. Higher demand means higher secondary market prices. Authorized dealers face long waiting lists.

Limited Production Strategy by Rolex

Rolex controls supply very carefully. The brand avoids mass production intentionally. This strategy preserves exclusivity and desirability. Annual production remains limited compared to demand. Estimates suggest under one million watches annually. Demand far exceeds that production volume.

Rolex prices rise due to artificial scarcity. Scarcity increases both retail and resale values. Limited availability strengthens brand prestige. This controlled supply remains unchanged in 2026. Rolex refuses to expand production significantly.

Authorized Dealer Shortages Persist

Authorized dealers cannot meet customer demand. Popular models sell out immediately upon arrival. Customers face waiting periods lasting several years. Steel sports models face extreme shortages. Daytona models remain nearly unobtainable at retail. Submariner demand stays extremely high.

Rolex prices increase due to dealer scarcity. Buyers turn toward secondary markets instead. Secondary sellers raise prices aggressively. Dealer shortages push resale premiums higher. This trend intensifies throughout 2026.

Secondary Market Drives Price Growth

The secondary watch market heavily influences pricing. Grey market dealers respond rapidly to demand changes. Prices adjust daily based on availability. Rolex prices fluctuate strongly on resale platforms. Popular references command massive premiums. Condition and completeness impact resale value greatly.

Investors treat Rolex watches like commodities. Market speculation drives rapid price increases. Limited listings increase perceived scarcity. Social media accelerates resale market hype. Influencers highlight rising rolex prices publicly.

Inflation Impacts Luxury Watch Pricing

Global inflation continues affecting luxury goods. Material costs increase across Swiss manufacturing. Labor costs rise within Switzerland. Transportation expenses remain elevated globally. Currency fluctuations affect international pricing. Swiss franc strength increases export costs.

Rolex prices rise partly due to inflation. Manufacturing expenses push retail prices upward. Brand positioning absorbs inflation strategically. Luxury buyers tolerate higher pricing comfortably. Inflation pressures remain strong during 2026.

Rising Precious Metal Costs

Gold prices continue climbing globally. Platinum also experiences strong market demand. Rolex uses premium precious metals extensively. Gold Daytona models cost significantly more. Day-Date watches rely heavily on precious metals. Material costs directly influence retail pricing.

Rolex prices rise with precious metal costs. Buyers accept higher precious metal premiums.

Luxury buyers value intrinsic material worth. This factor remains important in 2026.

Brand Power and Heritage Strength

Rolex maintains unmatched brand recognition. The crown logo symbolizes status worldwide.

Brand trust remains extremely high. Heritage strengthens perceived long-term value. Collectors value historical continuity strongly. Rolex models retain design consistency.

Rolex prices benefit from brand authority. Consumers trust Rolex resale stability. Brand power justifies higher prices. Few brands rival Rolex prestige globally. This dominance sustains price growth.

Investment Demand Grows Stronger

Watches increasingly attract alternative investors. Rolex models outperform many traditional assets. Some watches deliver double digit returns. Daytona appreciation attracts global investors. Vintage references show exceptional long-term growth. Modern references follow similar trends.

Rolex prices rise due to investment demand. Buyers hold watches instead of selling. Reduced supply raises market prices further. Investment forums fuel speculative interest. 2026 sees continued investment enthusiasm.

Celebrity Influence Boosts Demand

Celebrities frequently wear Rolex watches publicly. Athletes favor Daytona and Submariner models. Actors showcase Rolex during media appearances. Social media amplifies celebrity influence. Fans replicate celebrity watch choices. This increases demand rapidly.

Rolex prices react to celebrity exposure. Certain models spike after public appearances. Limited supply amplifies this effect. Celebrity endorsement remains organic and powerful. This trend continues in 2026.

Model Discontinuations Increase Prices

Rolex occasionally discontinues popular models. Discontinuations instantly boost secondary values. Collectors rush to secure discontinued references. Examples include specific dial variations. Small design changes trigger price spikes. Collector’s value discontinued uniqueness.

Rolex prices surge after discontinuation announcements. Speculation increases across marketplaces. Discontinued models gain long-term appreciation. This pattern remains consistent historically. 2026 sees similar collector behavior.

Rising Retail Prices from Rolex

Rolex adjusts retail prices annually. These increases reflect inflation and demand. Retail hikes impact resale pricing instantly. Authorized dealer prices influence secondary markets. Resellers base premiums on retail benchmarks. Higher retail equals higher resale. Rolex prices increase at both levels. Buyers rush before future increases. Fear of missing out accelerates demand. Annual adjustments expected again in 2026.

Supply Chain Pressures Continue

Global supply chains remain under strain. Component sourcing faces occasional delays. Logistics disruptions impact production scheduling. Rolex prioritizes quality over speed. Delays reduce overall shipment volumes. Fewer shipments increase scarcity. Rolex prices rise due to constrained logistics. Delayed deliveries limit dealer availability. Market reacts with price premiums. Supply challenges persist into 2026.

Rising Demand for Steel Sports Models

Steel sports models dominate Rolex demand. Buyers prefer durability and versatility. Steel models offer strong resale value. Submariner remains extremely popular. GMT Master attracts travel enthusiasts. Explorer appeals to minimalist buyers. Rolex prices rise fastest for steel models. Steel scarcity outpaces precious metal availability. Demand far exceeds production volumes. This trend defines 2026 Rolex pricing.

Online Communities Drive Market Psychology

Online forums influence buyer behavior heavily. Price tracking websites increase transparency.

Buyers monitor daily market changes. Fear driven buying pushes prices higher. Hype cycles create short-term surges. Market sentiment impacts resale values.

Rolex prices respond to online sentiment. Positive discussions increase demand quickly. Negative news rarely impacts Rolex strongly. Digital communities shape modern luxury markets.

Rolex Prices Will Keep Rising

Rolex prices show no signs of slowing. Demand remains far above available supply. Brand power continues strengthening globally. Investment interest remains extremely strong. Inflation supports long-term price increases. Scarcity reinforces resale premiums. Rolex prices reflect economic and emotional value. Collectors trust Rolex stability deeply. Luxury buyers accept rising prices confidently. The 2026 market favors sellers strongly. Buyers must act decisively and strategically. Rolex prices will likely rise further ahead.

FAQ’s

Are Rolex prices still rising in 2026?

Yes. Rolex officially raised retail prices globally in 2026 by roughly 4 %–9 % depending on the model and material. Stainless steel models increased around 5 %–7 %, while gold and precious‑metal references saw higher hikes (about 8 %–9 %) due to material costs and inflation. Steel sports models such as Submariner and Daytona also recorded notable increases.

Is demand for Rolex watches still strong in 2026?

Yes, demand remains strong overall, especially for core models like the Submariner, GMT‑Master II, Datejust, and Daytona. Collectors and investors continue to value these models due to historical resale performance, prestige, and scarcity — boosting interest even after the pandemic boom’s peak.

What’s the main reason Rolex prices jumped in 2026?

Rolex price increases in 2026 are driven by several real factors:

- Rising raw material costs (especially gold and precious metals),

- Inflation in manufacturing and labor expenses,

- Ongoing global economic pressures,

- Tariffs and duty adjustments on Swiss imports, and

- Rolex’s strategic pricing approach to preserve exclusivity.

Together these push rolex prices higher across many models.

Have secondhand Rolex prices fallen or risen in 2026?

While retail rolex prices are increasing, secondary‑market pricing has softened compared to its pandemic peak. Industry analysts report a significant slump in the high‑end watch market, with resale values down from their historic peaks, though still above pre‑pandemic levels. The secondary market has shown modest recent rebounds but remains more conservative than 2021–2022 highs.

Which Rolex models are most impacted by price changes in 2026?

Heavily impacted:

- Precious‑metal models (gold, Everose, high jewelry) — larger increases (~8 %–10 %) on retail lists.

- Rolesor and two‑tone models — moderate increases (5 %–7 %).

Less impacted:Basic steel models (Oyster Perpetual, some Submariners) — smaller increases (2 %–5 %).

Demand for steel sports references continues to exceed supply, keeping their secondary market premiums elevated.