Gold Jewelry Investment: Is It Better Than Stocks in 2025–2026?

Gold has always fascinated humans. Its shine signals wealth, security, and prestige. Many people ask about gold jewelry investment. They want to know if it pays off. This article explores this question deeply. It explains facts, trends, and expert views. We keep sentences short and clear.

Gold Price Trends in 2025

Gold prices soared in 2025. Asia saw a near 67% annual jump in gold prices. Global markets also hit record highs. This rise outpaced most stocks and bonds. Demand for safe assets increased sharply. Investors bought gold as a safety hedge. However, most investors preferred bars and coins. Jewelry demand fell because prices were high. Consumers avoided making charges. They bought lighter, affordable pieces instead. This shift matters for gold jewelry investment.

Gold Price Forecast for 2026

Experts predict mixed outcomes in 2026. Deutsche Bank forecasts gold near $4,450/oz. Some forecasts even suggest $5,000 levels. World Gold Council expects possible gains too. Yet price swings could occur. Bullish scenarios depend on global risks. Bearish scenarios depend on strong economies. Overall, gold remains strong long term. But gold jewelry investment depends on timing.

What Is Gold Jewelry Investment?

Gold jewelry investment means buying gold jewelry to profit. People buy pieces hoping prices rise. They see jewelry as both ornament and asset. In some cultures, jewelry is wealth storage. A Deloitte report shows 86% of Asians view gold jewelry as wealth. But jewelry is not pure bullion. Pure gold bars have no craftsmanship cost. But jewelry includes heavy premiums. These premiums reduce immediate sale value.

Pros of Gold Jewelry Investment

1. Tangible Asset

Gold jewelry is physical. You can hold it in your hand. This appeals to emotional investors.

2. Cultural Value

Jewelry has cultural importance in many regions. In Asia, weddings involve gold jewelry. This maintains steady demand for ornaments.

3. Inflation Hedge

When prices soar, gold often gains too. Experts see gold as inflation protection.

4. Long‑Term Store of Value

Gold holds value over decades. Even if price fluctuates, the long run is positive.

5. Sentimental Importance

Jewelry has gift and heirloom value. This boosts demand beyond pure investment.

Cons of Gold Jewelry Investment

1. High Making Charges

Jewelry has craftsmanship premiums. This raises purchase cost heavily. The sale price rarely includes these premiums.

2. Lower Liquidity

Selling jewelry takes time. You cannot sell instantly at spot price.

3. Price Volatility

Gold prices can fall short term. If prices dip, losses occur.

4. Not Pure Gold Value

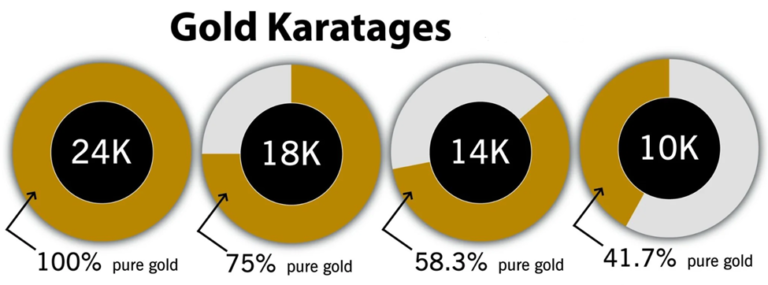

Jewelry has alloys and design costs. This reduces metal purity value.

5. Retail Margins Are Lower

Jewelers pay less than the market rate. Weighed, pure gold sells better than ornaments.

Expert Views on Gold Jewelry Investment in 2026

Experts often differentiate bullion and jewelry. They agree gold rises long term. But many experts caution about jewelry. They say jewelry is worse than bars or coins. Some financial analysts even warn buying jewelry solely as investment can lose money. Still, jewelry with low premiums and heavy weight can work. Especially designs with less gemstone cost. 14K gold pieces are growing in popularity. They combine metal value and daily usefulness.

Gold Jewelry vs Pure Gold Investment

Pure gold investment includes:

1. Gold bars

2. Gold coins

3. SGBs (Sovereign Gold Bonds)

4. Gold ETFs

These avoid high premiums. They track spot prices closely. Gold jewelry investment has broader costs. High craftsmanship and GST add to cost. This reduces profit margins on sale. For pure investment returns, bullion is better. Investors needing liquidity prefer ETFs or bonds.

Gold Jewelry as Part of a Portfolio

Experts often recommend diversification. Don’t put all money in one asset. Mix stocks, bonds, and gold. Gold jewelry can be a portion. Especially in societies valuing gold ornaments. A typical recommendation is 5–12% in gold. Specific ratios vary by investor goals. Risk‑averse people might hold more gold. Aggressive investors prefer stocks.

When Is Gold Jewelry Investment Smart?

1. Long Horizon

If you plan for decades, it may pay. Gold historically rises long term.

2. High Demand Seasons

Festivals and weddings boost jewelry demand. This can drive the prices of ornaments.

3. Lower Premium Pieces

Choose designs with lower extra costs. Heavy chains with less art add value.

4. Cultural Context

In cultures valuing gold heirlooms, jewelry holds traditional worth.

When It Is Not Smart

1. Short Horizon

If you need money soon, avoid jewelry.

2. High Premium Pieces

Expensive art or gemstone designs dilute investment value.

3. Strong Bullion Growth Expected

If pure gold outperforms jewelry prices.

Experts urge caution in timing. Gold can correct before rising again.

2026 Market Signals Affecting Jewelry Investment

Gold demand for jewelry has dipped. Investment demand rose instead. Jewelry consumption may decline further. This can weaken jewelry prices short term. But long-term value may remain.

Price Forecasts

Potential gains of 15–30% are possible. But volatility may surprise markets.

Global Demand Patterns

Central banks continue gold purchases. This supports the overall price floor.

Practical Tips before Investing

•

1. Check purity carefully.

2. Avoid high premiums.

3. Prefer simple designs.

4. Consider resale demand.

5. Consult trusted jeweler.

6. Track global gold prices.

Cultural Edge in Some Markets

In India, UAE, Pakistan, and many Asian countries, gold jewelry is prized. People value it beyond investment logic. This creates steady demand.

What Investors Often Miss

Some investors overestimate jewelry resale value. They forget jeweler commissions. They forget GST and make charges. This reduces net gains.

Conclusion

Is gold jewelry investment smart in 2025–2026? The Answer depends on your goals. It can protect wealth long term. But jewelry itself is not an ideal pure investment. It has extra costs and lower liquidity. Pure gold investments often outperform jewelry. Yet jewelry can still hold value. It combines cultural, sentimental, and financial worth. If profits matter more, prefer bullion and ETFs. If tradition matters, jewelry adds meaning. Smart investors balance both strategies. Gold jewelry investment can be smart. But only with strategic, informed choices.

FAQ’S

1. What is gold jewelry investment?

Gold jewelry investment means buying gold jewelry to store wealth or profit. It combines ornamental value with investment potential. Unlike gold bars or coins, jewelry has making charges and design costs, which may affect resale value.

2. Is gold jewelry a good hedge against inflation?

Yes, gold jewelry generally retains value during inflation. When prices rise, gold often gains, protecting wealth. However, making charges reduce immediate resale returns compared to pure gold.

3. Should I invest in gold jewelry or gold bars/coins?

Gold bars or coins are better for pure investment. They track market prices and have low premiums. Jewelry is best for cultural or sentimental purposes but can still serve as a long-term wealth store.

4. How do making charges affect gold jewelry investment?

Making charges add cost beyond the gold content. This increases purchase price but is not fully recoverable when reselling. Low-premium designs offer better investment potential.

5. Is gold jewelry investment smart in 2025–2026?

It can be smart for long-term wealth and cultural reasons. But jewelry alone is not ideal for pure profit. Combining jewelry with gold bars or ETFs is the safest strategy.