Gold Jewelry a Hedge: Practical Investment Guide for 2026

Inflation worries many households in 2026. Daily expenses rise quickly. Savings lose purchasing power. People search for safer assets. Gold attracts global attention during uncertain periods. It feels stable. It feels familiar. Jewelry adds emotional value. Many investors now ask whether gold jewelry a hedge truly works against inflation.

Understanding Inflation in 2026

Inflation reduces money value over time. Food costs more. Housing costs more. Fuel prices fluctuate frequently. Central banks try controlling inflation through interest rates. Markets remain volatile despite these efforts.

According to World Gold Council, gold demand historically rises during inflation cycles. Investors move toward physical assets. They fear currency weakness. Cash holders suffer most. Hard assets often perform better. Gold remains among the top choices.

Why Gold Holds Historical Power

Gold has stored value for thousands of years. Civilizations trusted it. Empires collapsed. Gold survived. It cannot be printed. Supply grows slowly. Demand stays steady. These factors protect long-term value. Gold resists currency devaluation. Jewelry adds portability and personal ownership. People feel safer holding physical assets. This explains why gold jewelry a hedge remains popular worldwide.

Gold Jewelry Vs Paper Gold

Gold jewelry differs from ETFs or digital gold. Jewelry stays physical. Paper gold stays electronic. Jewelry offers wearable wealth. It provides beauty and savings together. ETFs only track price movements. Physical ownership matters during crises. Jewelry can be sold anywhere. It carries emotional importance. Families pass it across generations. That trust gives gold jewelry a hedge stronger psychological value.

Gold Jewelry a Hedge: The Core Concept

Gold jewelry a hedge means protection against inflation. It means preserving purchasing power. It also means holding tangible wealth. Gold jewelry a hedge offers liquidity. You can sell pieces anytime. Gold jewelry a hedge provides portability. You carry value easily. Gold jewelry a hedge also delivers emotional security. Families rely on it during emergencies. Experts agree that gold preserves wealth over long periods, even when currencies weaken.

Expert Views on Gold Jewelry in 2026

Many analysts support moderate gold exposure in 2026. They cite rising global debt and economic uncertainty. Some experts from Federal Reserve warn inflation pressures may persist despite rate changes. Financial planners recommend diversification. They advise combining stocks, property, and gold. Gold jewelry fits lifestyle investing. It blends personal use with financial protection. Experts caution against overconcentration.

How Gold Jewelry Performs During Inflation

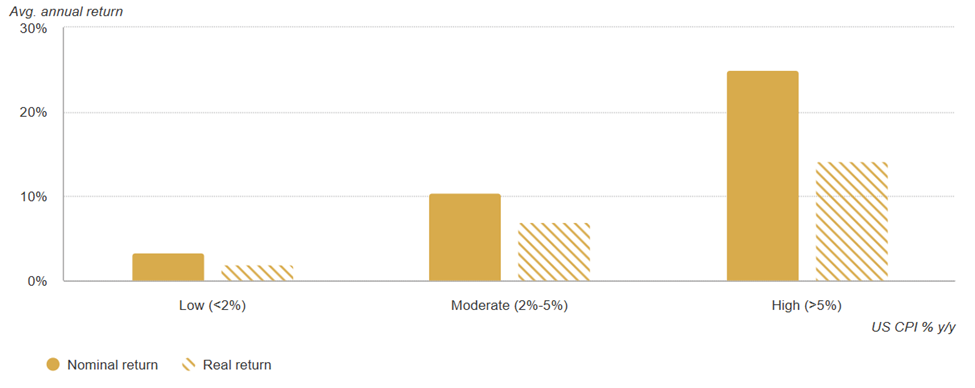

Gold Price vs Inflation: Long‑Term Trend

Historically, gold has co‑moved with inflation. According to research by the World Gold Council, gold prices outpaced inflation over decades, especially when inflation was high. During periods when inflation ran between 2–5% annually, gold prices rose roughly 10% per year on average.

This graph helps explain why gold jewelry a hedge often works long term because gold’s price historically rises faster than inflation.

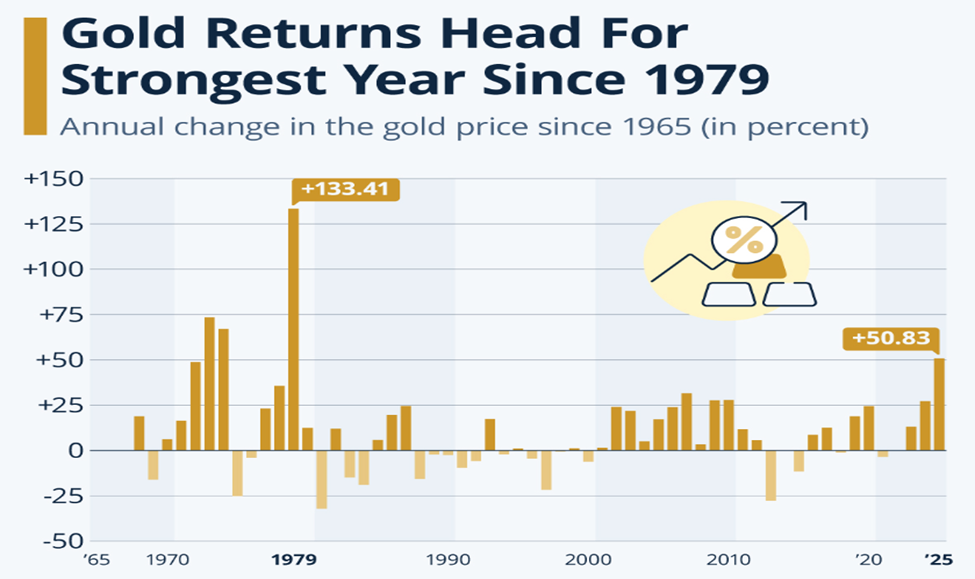

Annual Returns Compared to Inflation

Another useful visual shows year‑by‑year gold returns over decades. Statista data highlights average annual gold returns versus inflation: gold often appreciated about 8–10% annually over long periods, while inflation hovered closer to 3–4% on average.

This bar chart illustrates gold’s annual price changes across decades. It helps demonstrate how gold responds during inflationary phases. When inflation rises sharply, gold often rallies. This supports why gold jewelry a hedge can preserve value over years.

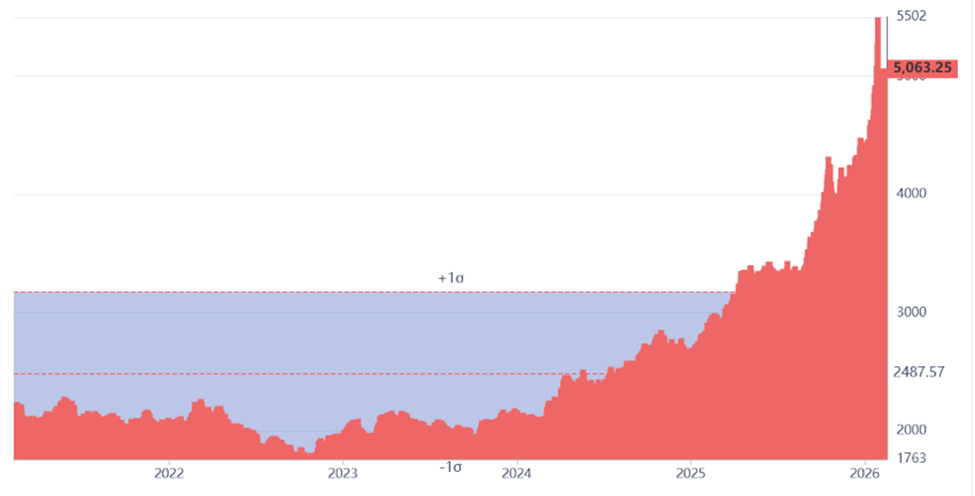

Modern Gold Price Performance (2025–2026)

Recent prices also reinforce gold’s resilient behavior:

- In 2025, gold saw dramatic gains, rising approximately 74% in India amid tariff‑ and inflation‑linked uncertainty — the largest surge since the pandemic era.

- In **early 2026, spot gold touched around $5,074 per ounce, reflecting continued safe‑haven demand amid economic volatility.

- Softer inflation data in early 2026 renewed gold’s appeal, with prices climbing even higher as rate‑cut expectations increased.

Inflation‑Adjusted Gold Value

Gold’s value adjusted for inflation shows real wealth preservation. Inflation‑adjusted gold price data shows gold’s adjusted value near long‑term highs in early 2026, far above its historical average.

This line chart shows real gold price growth versus inflation, helping readers see how gold retains purchasing power.

Seasonal and Cultural Demand Boosts Jewelry Performance

Beyond price data, gold jewelry’s performance also depends on demand patterns.

• In India and Asia, seasonal festivals and weddings drive strong gold purchases.

• Cultural attachment supports jewelry pricing even when markets dip.

These demand patterns strengthen why gold jewelry a hedge can protect value in markets with recurring gold demand.

Advantages of Using Gold Jewelry as Inflation Protection

Gold jewelry lasts decades. It never expires. It offers resale markets worldwide. Pawn shops accept it easily. It protects against currency devaluation. When money weakens, gold remains strong. Gold jewelry also provides emergency liquidity. Cash becomes available quickly. Gold jewelry a hedge works well during financial stress. It combines beauty with financial security.

Limitations You Must Understand

Jewelry includes labor costs. These reduce resale returns. Fashion styles change. Older designs may sell slower. Storage carries theft risk. Insurance adds expense. Gold prices fluctuate yearly. Jewelry generates no income. Experts advise moderation. Gold should support portfolios, not replace them.

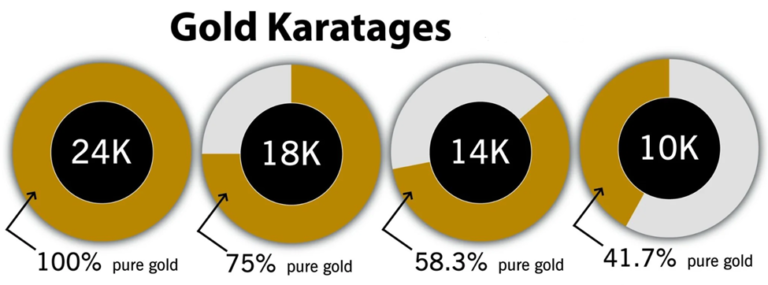

Karat Matters for Investment Jewelry

Higher karat means higher gold content. Twenty-two karat performs better for investment. Twenty-four karat stays pure but feels soft. Fourteen karat suits daily wear but holds less gold. Investment buyers prefer higher purity

Jewelry Types That Hold Value Best

Not all gold jewelry holds its value equally. Some pieces maintain metal worth better. Others lose value due to trends, design, or heavy making charges. Here’s a deeper breakdown.

1. Simple Bangles

Simple bangles are a classic investment choice. They contain mostly gold with minimal ornamentation. Because of low labor costs, resale mostly recovers the gold content.

Data Insight:

- In India, resale of plain 22K gold bangles recovers 90–95% of metal value, according to local jewelers.

- Even older designs continue to sell well during weddings or festivals.

Why it holds value:

- Minimal design avoids fashion obsolescence.

- Easy to weigh and sell in bulk.

- Cultural demand remains high, especially in Asia.

2. Chains and Necklaces

Gold chains maintain weight value effectively. They are easy to verify for karat and purity.

Thicker, heavier chains retain more metal content.

Data Insight:

- 22K gold chains weighing 50 grams typically retain 85–90% resale value after deducting making charges.

- Thin, lightweight chains recover less due to higher proportion of making charges.

Why it holds value:

- Chains are widely demanded.

- Classic link styles do not go out of fashion.

- Liquidity is high — buyers trust weight over style.

3. Heavy Rings

Rings with substantial gold content often outperform smaller pieces. Heavier rings retain metal value despite design changes. Even vintage rings maintain resale appeal if karat is high.

Data Insight:

- 22K and 18K heavy rings show resale recovery of 80–88%, depending on design complexity.

- Rings with minimal stones or plain bands retain more metal value than heavily studded rings.

Why it holds value:

- Weight is directly proportional to resale worth.

- Minimalistic rings are easier to sell than fashion-oriented designs.

4. Minimal Designs

Jewelry with simple, classic designs ages better over time. Avoid flashy or overly trendy pieces that may lose buyer interest.

Data Insight:

- Studies show that classic gold pendants retain 15–20% more resale value than trend-driven designs after 5–10 years.

- Minimal designs also face fewer discounts in resale markets.

Why it holds value:

- Timeless styles remain in demand globally.

- Easier to appraise and sell in international markets.

- Works well as a long-term investment.

Gold Jewelry a Hedge in Long-Term Planning

Advisors recommend balanced portfolios, Stocks, Real estate, Gold, Gold jewelry fits this strategy. Gold jewelry a hedge complements savings. It should represent five to fifteen percent of assets. Never rely on gold alone. Gold jewelry a hedge works best with patience.

Cultural Power Strengthens Jewelry Demand

Asian weddings drive massive gold purchases. Middle Eastern traditions favor heavy ornaments. Festivals boost sales yearly. Cultural attachment supports pricing. Emotional value increases holding behavior. This stability strengthens gold jewelry a hedge globally.

Is Gold Jewelry a Hedge Against Inflation in 2026?

Yes, with conditions. Gold jewelry a hedge works long term. It does not guarantee quick profits. Gold jewelry a hedge protects purchasing power. It suits conservative savers and adds emotional security. It requires disciplined buying. Experts support cautious use.

Final Expert Suggestions

Buy higher karat pieces. Prefer classic designs. Limit making charges. Diversify assets. Hold long term. Ignore daily fluctuations. Treat jewelry as wealth insurance. Gold jewelry a hedge rewards patience. Inflation challenges households everywhere. Cash loses strength. Gold offers protection. Jewelry adds usability. Gold jewelry a hedge remains relevant in 2026. Experts support moderate exposure. It preserves wealth and carries tradition. It provides security. Use it wisely. Think long term. Buy smart. Hold calmly.

FAQ’s

1. Which gold jewelry types retain value best?

Simple bangles, thick chains, and heavy rings hold value well. Minimalist designs also age better. Avoid trendy or heavily customized pieces. These maintain higher resale and metal value.

2. Why are simple bangles considered a safe investment?

They have minimal design, low making charges, and mostly gold content. Resale recovers 90–95% of metal value. Cultural demand keeps them liquid in Asian and Middle Eastern markets.

3. How do chains and necklaces perform in resale?

Chains maintain weight-based value effectively. Heavier, classic link chains resell better. Thin, ornate chains recover less due to proportionally higher making charges.

4. Should I avoid trendy gold jewelry for long-term investment?

Yes. Trendy or heavily customized pieces lose appeal quickly. They recover 10–25% less value on resale. Minimal and classic designs are safer for long-term wealth preservation.